- The Raise Report

- Posts

- The New Capital Raise Research Stack

The New Capital Raise Research Stack

How I Mapped 60 Family Offices in 5 Hours Using AI (And Why This Changes Everything for GPs)

Hey there, Domingo here 👋

Welcome to The Raise Report - where we break down how top real estate sponsors are raising capital and scaling their portfolios.

This week's edition is different. No guest. No interview. Just me pulling back the curtain on something I built last week that's been getting a lot of attention.

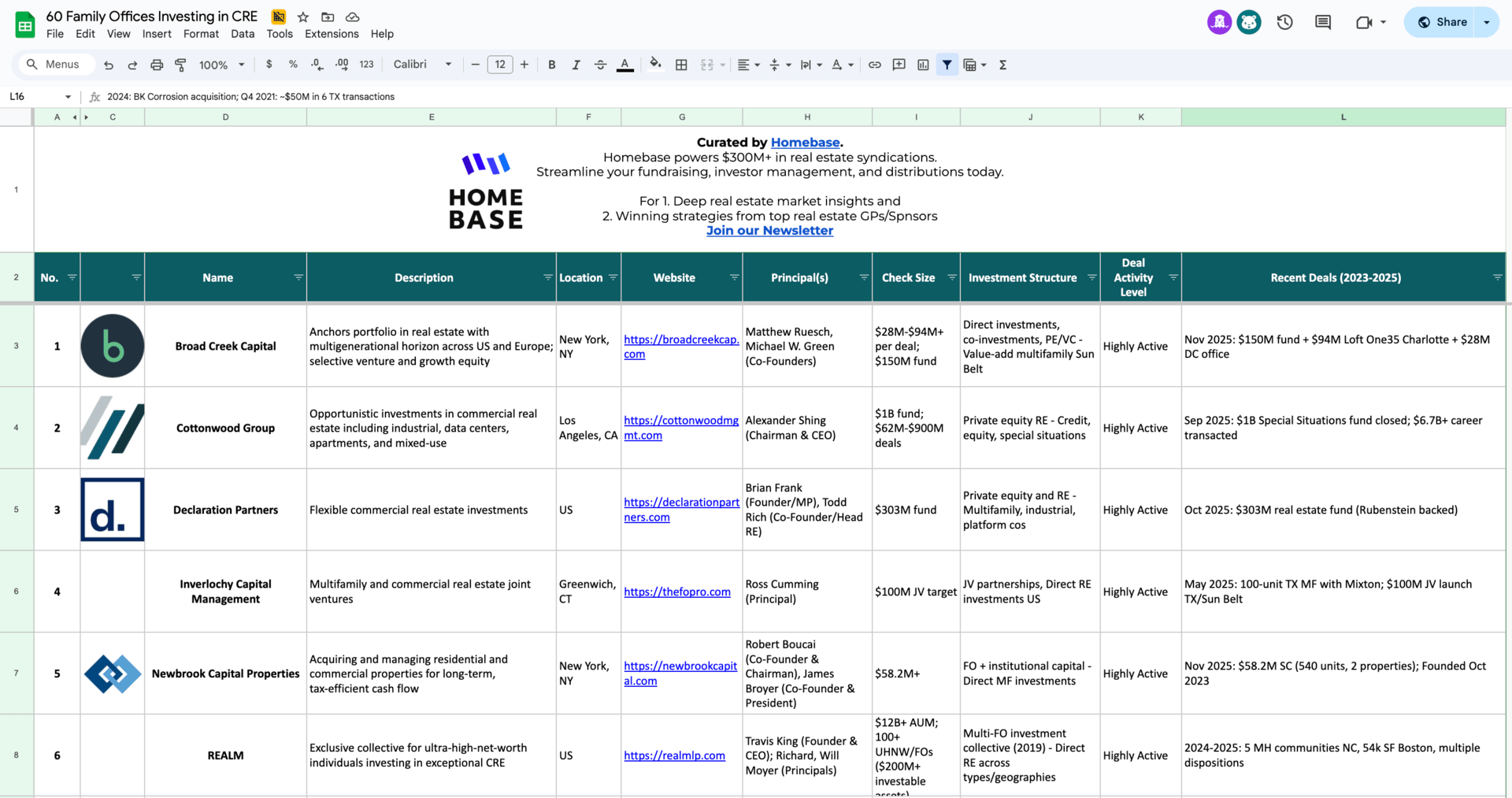

I mapped 60 family offices actively deploying into US commercial real estate. Decision makers, check sizes, recent deals, investment structures - the whole picture.

I didn't use PitchBook. I didn't use Preqin. I didn't pay a research firm $10,000.

I used AI. It took 5 hours. It cost $0.

And honestly? It's one of the most valuable things I've built in months.

But this blog isn't really about family offices. It's about what's now possible for GPs who learn to use these tools. Because the list was just one experiment. The real unlock is the capability itself.

The Old Way Is Expensive and Slow

Let's be honest about how most GPs source capital relationships today.

Option 1: Buy a database PitchBook, Preqin, PERE - these are fantastic tools. They're also $15,000 to $50,000 per year. For an emerging GP raising their second or third fund, that's a real line item.

Option 2: Hire a researcher You can pay someone to manually scrape LinkedIn, comb through press releases, and build you a list. It works, but it takes weeks and the data goes stale fast.

Option 3: Work your network The classic approach. Warm intros, conferences, relationship building. Still the gold standard for closing capital - but brutal for discovering new relationships at scale.

None of these options are wrong. But they all have the same limitation: they're slow, expensive, or both.

What if there was a fourth option?

The New Research Stack

Here's what I've learned over the past few months: AI doesn't just write emails faster. It fundamentally changes what a single person can research, synthesize, and build.

The stack I used for the family office project:

1. Exa (AI-powered search) Unlike Google, Exa understands semantic meaning. I could search for "family offices investing in commercial real estate" and get results that actually matched - not just keyword spam.

2. Perplexity (AI research assistant) Once I had initial names, I fed them into Perplexity to enrich. It pulled recent deals, principal names, LinkedIn profiles, check sizes - synthesized from dozens of sources in seconds.

3. Claude (analysis and organization) This is where it all came together. Claude helped me deduplicate the list, standardize formats, extract patterns, tier by activity level, and build the final deliverable.

4. Google Sheets (output) The end product. A clean, sortable database with 60 family offices, ready for outreach.

Total time: 5 hours. Total cost: $0 (free tiers of all tools).

The Exact Process I Followed

Let me break down the workflow step by step.

Step 1: Initial Discovery (1-2 hours)

I started with Exa, running searches like:

"family offices investing in commercial real estate"

"family office multifamily investment 2024"

"family office real estate LP commitments"

This gave me a raw list of ~100 names with basic descriptions. Lots of duplicates. Inconsistent data. But a starting point.

Step 2: Enrichment (2-3 hours)

I took that list and fed it into Perplexity with a detailed prompt:

"Research [Family Office Name] and find: Principal/founder names, recent real estate deals (2023-2025), typical check sizes, investment structure preferences (LP, co-GP, direct), and LinkedIn profiles for key decision makers."

I ran this in batches of 10-15 at a time. Perplexity pulled from press releases, SEC filings, news articles, and company websites to fill in the gaps.

Step 3: Cleaning and Analysis (1 hour)

This is where Claude earned its keep. I uploaded the enriched data and asked it to:

Deduplicate entries (some offices appeared 4-5 times with slight variations)

Standardize location and website formats

Flag any that weren't actually real estate focused (two turned out to be biotech VCs)

Tier the list by activity level:

Tier 1: Multiple recent deals, highly active, larger checks

Tier 2: Verified deals, solid targets

Tier 3: Established but less recent activity

Step 4: Final Output

Claude formatted everything into a clean spreadsheet with columns for:

Name, Website, Location

Principal(s) and LinkedIn

CRE focus and investment structure

Check size and recent deals

Activity signal and outreach priority

I even had it generate Clearbit logo URLs so the final sheet looked polished.

What I Found

The output was genuinely useful:

60 verified family offices actively investing in US commercial real estate.

6 Tier 1 targets worth immediate outreach:

Broad Creek Capital ($28M-$94M per deal, Sun Belt multifamily)

Cottonwood Group ($1B special situations fund, $6.7B+ career)

Declaration Partners ($303M RE fund, Rubenstein-backed)

Inverlochy Capital Management ($100M JV target, TX/Sun Belt)

Newbrook Capital Properties ($58M+ deals, founded Oct 2023)

REALM ($12B+ AUM, 100+ UHNW members)

20 Tier 2 targets with verified deal activity.

Key patterns I noticed:

Multifamily and industrial dominate - these are the asset classes family offices want

Sun Belt markets (TX, FL, Southeast) are heavily targeted

Many prefer co-GP and JV structures over passive LP positions

"Gap capital" and preferred equity are growing themes

New family offices from tech/PE exits are actively deploying

This would have taken a research analyst weeks to compile. It took me an afternoon.

But Here's the Real Point

The family office list is just one example. The real story is what's now possible.

Think about everything a GP does that involves research, synthesis, or organization:

Investor research

Map family offices, RIAs, or institutional allocators

Track who's actively deploying and who's on pause

Build targeted outreach lists by geography or asset class

Market analysis

Synthesize rent comps across a submarket

Pull demographic trends for an investment memo

Compare cap rate movements across MSAs

Deal sourcing

Monitor press releases for distressed sellers

Track loan maturities in your target markets

Identify GPs who might need rescue capital

Investor communications

Draft quarterly updates from bullet points

Generate FAQ responses from your PPM

Create personalized follow-ups based on investor preferences

Back office

Extract data from K-1s or operating agreements

Standardize reporting across multiple properties

Build templates for recurring processes

Every single one of these can be accelerated - or fully automated - with the right AI workflow.

Your Limit Is Your Imagination

I've been playing with these tools for months now, and I keep finding new applications.

Last week it was family offices. Before that, I used Claude to:

Analyze 50 pages of partnership agreements and flag key terms

Generate a year's worth of newsletter topic ideas

Build a scoring model for investor lead qualification

Create SOPs for our internal processes

None of this required code. None of it required a technical background. Just clear prompts and a willingness to experiment.

The GPs who figure this out will operate at a different speed than everyone else. Not because they're smarter or better funded. Because they're leveraging tools that didn't exist 18 months ago.

The ones who don't? They'll keep doing things the old way. It'll still work. It'll just take longer and cost more.

What You Can Steal From This

1. Start with a specific question AI works best when you give it a clear target. "Help me with investor research" is weak. "Find family offices that invested in multifamily in the Southeast in 2024" is strong.

2. Use multiple tools in sequence No single AI tool does everything well. Exa is great for discovery. Perplexity is great for enrichment. Claude is great for synthesis. Chain them together.

3. Iterate on your prompts My first prompt gave me mediocre results. My fifth prompt gave me exactly what I needed. Treat prompting like a skill - it gets better with practice.

4. Trust but verify AI can hallucinate. Always spot-check critical data points. Use the output as a starting point, not the final word.

5. Build workflows, not one-offs The family office project taught me a repeatable process. Now I can run it again for RIAs, pension funds, or any other investor type. The first project is an investment; the second is nearly free.

The Takeaway

We're in a window right now where these tools are available, powerful, and underutilized.

Most GPs haven't touched them. They're still doing research the old way. Still paying for databases they don't fully use. Still spending hours on tasks that could take minutes.

That's an edge if you move early.

Not because AI replaces the relationship game - it doesn't. You still need to get on calls, build trust, and close capital the old-fashioned way.

But everything that happens before the call? The research, the targeting, the preparation?

That just got 10x faster.

Want Help Building Your AI-Powered Capital Raise?

If you're a GP looking to level up in 2025, I'd love to chat.

At Homebase, we're building tools that help sponsors raise capital faster - from investor CRM to deal pages to reporting. But beyond the product, I genuinely enjoy helping GPs think through their capital raise strategy.

No pitch. Just a conversation about what's working in capital raising right now and how you can apply it.

And if you want the full family office list with all 60 offices, decision makers, check sizes, and deal activity. You can access it here.

Domingo Valadez

Homebase

Co-Founder & CEO